In December 2022, the Basel Committee on Banking Supervision (BCBS) published rules for handling crypto assets. These rules must be implemented by banks starting January 1, 2025. This blog post summarizes the impact of the new rules on tokenized securities.

A Brief Recap – What’s It All About?

All banks in Europe are subject to capital requirements. These are set as minimum standards within the “Basel III” reform package and are transferred into national regulations. Basel III takes a risk-based approach in determining the capital that must be deposited. This approach considers assets in both the trading book and the banking book of a bank. The trading book comprises all assets held by the bank with the intention of trading or hedging positions in the trading book. The banking book includes all assets on a bank’s balance sheet that do not fall into the trading book. However, it’s important to note that only assets that appear on the bank’s balance sheet are included in the risk-based approach to capital deposition. Off-balance sheet positions, particularly assets stored in customer deposits, do not need to be backed by capital.

How Does the Risk Weight Factor into the Capital Requirement Calculation?

At the heart of Basel III are the risk-weighted assets. 8% of these risk-weighted assets must always be backed by capital. The risk-weighted assets are calculated by dividing the assets on a bank’s balance sheet into different risk categories. The relevant figure here is the risk weight defined for each asset category. The higher the risk, the higher the risk weight, and therefore the higher the capital requirement for the bank. For example, a corporate bond with an A-rating has a risk weighting of 50% in the standard methodology, with a BBB-rating it’s 100%, and with a CCC rating it’s 150%. The capital requirement is then calculated using a simplified illustration as follows:

Capital Requirement = Risk Position × Risk Weighting × 8%

This results in the following capital requirement for holding a corporate bond with an A-rating of EUR 10 million on a bank’s balance sheet:

Capital Requirement = EUR 10 Million × 50% × 8% = EUR 400,000

What Categories of Digital Assets Are Distinguished?

The determination of risk weighting for digital assets has now been finalized. The committee responsible for Basel III of the Bank for International Settlements, the Basel Committee on Banking Supervision (BCBS), published the associated rulebook in December 2022 (https://www.bis.org/bcbs/publ/d545.htm)

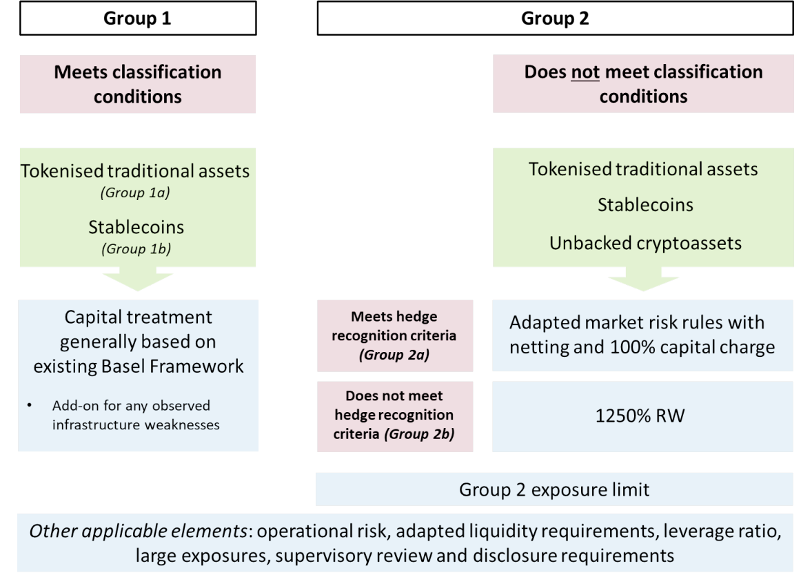

In the rulebook, digital assets are divided into three categories:

- Group 1a: Tokenized traditional assets that meet certain criteria

- Group 1b: Stablecoins that meet certain criteria

- Group 2: All other digital assets (tokenized securities and stablecoins that do not meet the specified criteria, and all other digital assets such as Bitcoin and Ether)

Image source: https://www.bis.org/bcbs/publ/d545.htm

CBDCs are explicitly excluded. This blog post focuses on tokenized securities (Group 1a).

What Conditions Must Be Met for a Tokenized Security to Fall into Group 1a?

For a digital asset to fall into Group 1a, a number of conditions must be met, namely:

- Condition 1: It must be a tokenized security. The asset must have the same level of credit and market risk as the traditional, non-tokenized security.

- Condition 2: All rights, obligations, and interests arising from the tokenized security are clearly defined and legally enforceable in the legal system in which the asset was issued. Moreover, the applicable legal frameworks ensure the finality of the settlement.

- Condition 3: The functions of the tokenized security and the network in which it operates are designed so that all essential risks are adequately mitigated and managed. This also includes that functions such as the validation and transfer of securities do not pose significant risks.

- Condition 4: Companies that carry out transfers or settlements must (i) be regulated and supervised or subject to appropriate risk management standards, and (ii) have a comprehensive governance framework and disclose it.

Banks are responsible for regularly monitoring that the digital assets continue to meet the conditions for classification into Group 1. All digital assets that do not meet, or no longer meet, the conditions fall into Group 2.

Can Tokenized Securities on a Permissionless Blockchain Belong to Group 1a?

The rulebook does not explicitly categorize assets into Group 1 or 2 based on permissionless or permissioned blockchains. However, the conditions from the previous section leave questions open as to whether securities on permissionless blockchains (e.g., Ethereum) can meet the conditions. BCBS wants to subject this point to specific monitoring and review. The committee will continue to evaluate whether the risks of digital assets on permissionless blockchains can be sufficiently mitigated to allow their inclusion in Group 1, and if so, what adjustments to the classification conditions would be necessary.

What is the Risk Weighting for Tokenized Securities?

Depending on the group classification, the capital requirement differs. For the group of tokenized traditional assets (Group 1a), at least the same capital requirements apply as for the respective traditional assets. Therefore, a tokenized BBB corporate bond has at least the same risk weighting as a traditional BBB corporate bond (50%). An increase in the requirement is conceivable, for example, because the digital counterpart has higher liquidity risks if it were less easily tradable.

What Happens if Tokenized Securities Do Not Meet the Conditions of Group 1a?

If tokenized securities do not meet the criteria of Group 1a, they fall into Group 2 – together with classic cryptocurrencies such as Bitcoin and Ether. For this group, an extremely high risk weighting of 1250% is proposed. Using the above example again, a position of EUR 10 million in tokenized securities that do not meet the conditions would result in the following capital requirement:

Capital Requirement = Risk Position × Risk Weighting × 8%

Capital Requirement = EUR 10 Million × 1250% × 8% = EUR 10 Million.

The position must therefore be fully backed by capital. This ensures that the capital requirement covers the worst-case scenario: That the entire position must be written off to zero.

However, it is also important to mention again: The regulations concern assets in the trading book and the banking book of a bank. Positions outside the balance sheet, particularly assets stored in customer deposits, do not need to be backed by capital – regardless of which group they would be classified into.

Sources:

- BCBS. (Juni 2011). Basel III: Ein globaler Regulierungsrahmen für widerstandsfähigere Banken und Bankensysteme. https://www.bis.org/publ/bcbs189_de.pdf

- BCBS. (15. Dezember 2019a). CRE20: Standardised approach: individual exposures. https://www.bis.org/basel_framework/chapter/CRE/20.htm?inforce=20191215&published=20191215

- BCBS. (15. Dezember 2019b). RBC25: Boundary between the banking book and the trading book. https://www.bis.org/basel_framework/chapter/RBC/25.htm

- BCBS. (Dezember 2022). Prudential treatment of cryptoasset exposures. https://www.bis.org/bcbs/publ/d545.htm

- Kurt, L. & Kurt, D. (2022). Digitale Assets & Tokenisierung. Wiesbaden: Springer Gabler